best buy 401k rollover

This was my first experience purchasing precious metals. Rolling over a 401k into an IRA is easy.

How You Can Leverage Your 401 K To Buy A Franchise

Deal TD Ameritrade IRA ROLLOVER Roll Over Your Old 401K into a TD Ameritrade IRA.

. Using a direct rollover 55000 transfers from your plan at your old job to the one at your new job. Every representative at Goldco responded quickly when I reached out to them. Ive shared in the past the best options for saving for retirement with a side income and Ive leveraged a SEP IRA in the past.

If your new job offers a 401k plan that accepts rollover contributions you can transfer your 401k balance into another 401k plan. Pros and Cons of Doing an TSP Rollover into an IRA. Morningstar Envestnet Schwab Advent etc.

How to roll over your 401k into an IRA. Gold IRA 401K. Best Selling Buy Silver Online Buy Silver Toronto Featured Silver Silver Coins Special Deals Silver.

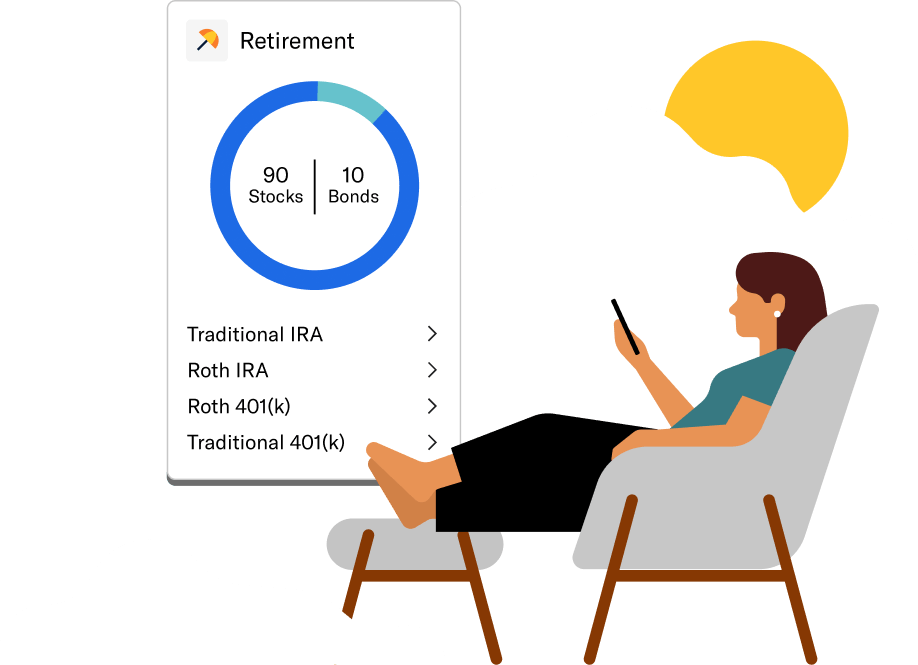

When you moved your 401k into a Traditional IRA that was called a Direct Rollover Now if you move your new Traditional IRA into a second Traditional IRA that is called a Direct Transfer When you buy the annuity the insurance company sets up your account as a Traditional IRA. Reasons to Roll Your IRA Into Your 401k A reverse rollover occurs when you transfer retirement assets from an IRA that you manage to your current employers 401k plan. A gold IRA often comes with higher fees than a traditional or Roth IRA that invests solely in stocks.

Choose a good brokerage to hold your account. A 401k rollover is a transfer of money from an old 401k to another 401k or an IRA. That match may offer a 100 return on your money depending on the 401k.

If the payment is made to you in the indirect rollover 11000 is. You sign up for your zip codes and these exclusive insurance leads investment leads financial planning leads social security leads 401k rollover leads and other lead types- see above. While IRAs generally enjoy fewer legal protections than 401k plans the owner of an IRA cannot borrow money from the account unlike a 401kThe age at which an IRA owner can take distributions is also greater than someone with a 401k who.

Click here to learn more about the PTE CRPA TM Advantage. There are plenty of reasons to withdraw money from a 401k or IRA early. Heres how to do a 401k rollover in 4 steps without a tax bill.

Fund your Solo 401k with a rollover or contribution. I was apprehensive about the process of rolling over money from my 401k into a precious metals IRA. However as my business income has grown a solo 401k is a better option for sheltering more money for retirement tax free today.

Can my Solo 401k buy real estate. Partially due to the pandemic partly due to larger balances more people are wondering whether they should withdraw funds from a 401k or IRA before retirement to help pay for life. If youre a buy-and-hold long-term investor Vanguard is an.

If your employer offers a 401k with a company match. The drawbacks of an in-service rollover mirror that of a regular rollover. Over 5 years ago I went on the hunt for the best solo 401k providers did my research and learned a whole lot.

Maintain all Investor related documentation in. How To Move a 401K Into Gold Without Penalties 2021. This article covers the main options such as leaving your funds within your TSP account rolling it into an IRA roll your assets into a 401k plan at your new employer withdraw your funds watch out for early withdrawal penalties and roll your funds into a qualified annuity.

The 401k Averages Book is the only resource available for non-biased 401k fee information comparison designed for financial service professionals. Find out if you are able to rollover your HSA funds whether youre bringing money from another HSA an IRA a 401k or another type of account. DPM is your one-stop store to buy gold and buy silver whether it be through our website or our retail store.

If your new employer doesnt have a retirement plan or if the portfolio options arent appealing consider staying in your old. The representative at Goldco took care of all the details with my investment company and the rollover went smoothly. Top Gold IRA Companies.

Broker Dealers and Registered Investment Advisors rely on 401k Averages Book data to populate parts of their 401k to IRA rollover recommendation and SECs Regulation Best Interest forms sec. PTE CRPA TM is easy to use. Consumers who respond to the ads matching your products services and selected zip codes are passed on to you.

Unfortunately some people go too far and end up using their 401k or IRA like a checking account instead of. Companies that buy direct can eliminate the middleman allowing them to reduce their markup. You do not qualify for a Solo 401k account and the Checkbook IRA is the best type of Self-Directed retirement account for you.

When considering a rollover of any variety it may help to work with a financial advisor who can guide you on your path to retirement. Youll never have to worry about getting the biggest discounts because we source the best deals and current money-saving coupon codes to. Drawbacks of an In-Service 401k Rollover.

Advisors can integrate reports from any other program into the PTE CRPA TM report ie. Just take the following five steps. Consider putting enough money in your 401k to get the maximum match.

And its better than a self directed IRA because your Solo 401k is exempt from taxes on. Whether youre a large firm or a solo advisor compliance with PTE 2020-02 is not an option. Code TJ Maxx 10 OFF.

Best online brokers for a 401k rollover. Find out whether your new employer has a defined contribution plan such as a 401k or 403b that allows rollovers from other plansEvaluate the new plans investment options to see whether they fit your investment style.

10 Big 401k Plans Suspending Matching Contributions In 2020 401 K Specialist

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

401 K Rollover To Ira Forbes Advisor

Rolling Over A 401 K To An Ira Can Cost You Thousands Of Dollars

401 K Rollover The Complete Guide 2022

Reporting 401k Rollover Into Ira H R Block

401k To Gold Ira Rollover Guide

Everything You Need To Know About 401 K S Money

Roll Over A 401k Or Ira Rollovers

Top 4 Reasons To Roll Over Your Old 401k To An Ira Finpowered Female

Gold Ira Rollover Guide How To Execute 401 K Rollovers To Gold Paid Content Cleveland Cleveland Scene

401k To Gold Ira Rollover Guide

401 K Rollover How To Roll Over A 401 K

How To Roll Over Your 401 K And Why Ally

How To Roll Over Retirement Savings To Buy A Business

Sjb Global Financial Pension Experts

401k To Gold Ira Rollover Guide